Compliance reporting is the process of understanding an organization’s compliance efforts. It is a report card of compliance practice that suggests the positive and negative aspects of compliance initiatives. In addition, compliance reporting can help organizations make uniform decisions in risk management and future planning—organizations with reporting foster a culture of transparency and responsible practices that ensure long-term success. Again, it can be a forward-thinking strategy for your growing business.

This article will explain the types and processes of compliance reports that help your compliance journey. You can invest a few minutes to clear your doubts about the compliance report. This article will indeed justify your efforts and intentions.

COMPLIANCE REPORTING

It is an ongoing process of creating and submitting reports that show the organization’s adherence to specific rules and regulations. The reports also explain the details of workplace safety, financial processes, ethical conduct, and data privacy. Further, some regulatory bodies or other entities make the compliance report mandatory for industries to understand the organization’s operating process. Therefore, organizations with incomplete reporting or incapable of submitting reporting can sometimes face hefty penalties and legal consequences.

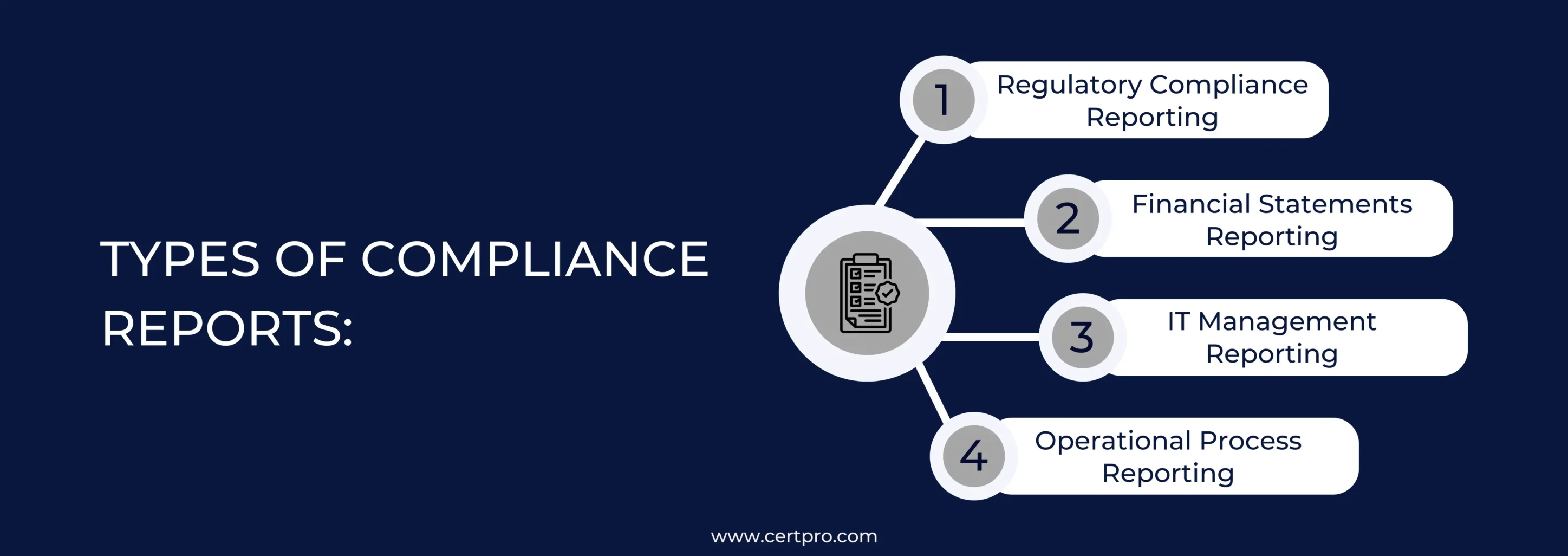

Types of compliance reports:

Reporting provides evidence of compliance practice for specific segments. Let’s discuss the types of compliance reports:

Regulatory Compliance Reporting: As the name suggests, reporting signifies an organization’s adherence to regulatory requirements. This kind of reporting is an external report that regulatory bodies will review. In addition, reporting depends on an organization’s industries, regulations, and locations.

Financial Statements Reporting: This reporting indicates an organization’s adherence to economic laws and standards. Again, the report consists of the balance sheet, income statements, and cash flow details. Thus, it helps recognize an organization’s financial health and the effectiveness of internal controls.

IT Management Reporting: The report details an organization’s information security and data privacy adherence. Thus, it shows an organization’s commitment to effective IT governance and helps recognize its best practices in data protection, privacy encryption, and storage.

Operational Process Reporting: Such reporting enlists an organization’s commitment to maintaining the operational standard and signifies the organization’s adherence to the industry-specific operational process. The reports include quality management, safety, and supply chain management details.

BENEFITS OF REPORTING IN BUSINESSES

Organizations working with sensitive customer data require reporting for their business continuity. Similarly, it helps the leaders understand their practice’s vulnerabilities and improve the gaps to avoid the consequences. Here we discuss some other benefits of the process:

Evidence of Compliance: Reporting denotes adherence to applicable regulations and standards. Therefore, it is considered evidence of compliance practice during the audit process. It helps eliminate the risk of non-compliance and penalties. Thus, reporting is beneficial for organizations to comply with regulations.

Improved Businesses: Compliance reports provide concise contextual insights into your business performance. In addition, it signifies organizations’ safety and financial measures. Therefore, the detailing can assist in identifying areas of vulnerability and measures to improve overall business performance.

Improved Client Assurance: Reporting helps develop market reputation and create transparency in ethical practice. Thus, organizations can improve their brand reputation and build customer trust. Hence, business opportunities are increased with the proper compliance reporting.

Risk Mitigation: Compliance reports help organizations identify risks and develop an effective mitigation strategy. Thus, it avoids non-compliance risks and helps develop proactive measures to manage them. The report ensures consistency in the organization’s policy and procedures.

Promotes Ongoing Improvement: The reporting can give organizations a clear view of compliance. Again, the report offers insight into the practice’s effectiveness and weaknesses. Thus, a scope of adjustment and recovery is always open for improvement.

EXAMPLES OF REPORTING IN BUSINESS

Compliance reports demonstrate the organization’s financial, regulation, operations, and IT status. Here, some examples of reporting are listed:

Generally Accepted Accounting Principles (GAAP): GAAP provides financial information about an organization. Therefore, public organizations require compliance with GAAP for financial reporting. This ensures that organizations meet their legal requirements for financial sector operations. Thus, the reporting protects participants from potential risks.

International Organization for Standardization (ISO): Such reporting describes the data security and quality controls. ISO reporting offers financial reporting, audit processes, and other details. It is a comprehensive framework that ensures organizations adhere to international standards, thereby enhancing trust, transparency, and operational efficiency across various industries.

Payment Card Industry (PCI): It is a security standard for safeguarding debit and credit card transaction information. The reporting provides proper security protocols for taking card payments, protects customer data from theft or misuse, and enables organizations to follow industry best practices for online transactions.

General Data Protection Regulation (GDPR): This regulation is essential for businesses in the European Union or businesses dependent on EU customers. Thus, reporting GDPR compliance signifies transparency in storing and handling EU customer data.

Health Insurance Portability and Accountability Act (HIPAA): Protects the privacy and security of personal health information. Reporting HIPAA ensures the organization follows a protocol to safeguard patient data from unauthorized access.

STEPS OF THE COMPLIANCE REPORTING PROCESS

Compliance reports require detailed information about the compliance practice. In this regard, appointing a Chief Compliance Officer (CCO) ensures the maintenance of protocol and regulations. Thus, use these steps to improve your compliance reports process:

Identify the Scope: Identify the scope of the compliance report and start planning for the compliance process. You should understand what is essential to tracking compliance and what evidence needs to be incorporated to prove it.

Program Owner: Successful reporting requires a project owner who knows the company’s goals and the rules that apply to it from outside sources. This person will develop processes, review data, manage team members, and compile records of documents. The project owner will figure out what the reporting needs and how to ensure that the reporting is accurate and appropriate.

Identify Internal Stakeholders: A compliance program often needs feedback from stakeholders. Thus, different individuals may have other ideas about the compliance process. The project owner should work with stakeholders to decide the compliance journey.

Standardize Reporting: Once you know the reporting process, set up a process for getting information, putting it all together, checking the facts, and writing the report. Thus, estimate the approximate timing for reporting and eliminate the risk of errors in reporting. Automation can help you simplify the overall reporting process.

Establish KPIs: Using metrics in your reporting will lead to better results. Set up Key Performance Indicators (KPIs) that you can use to judge the quality of your reporting and find areas for improvement. Thus, keep an eye on reports to find mistakes, problems, or differences in the data quality and any other patterns that need to change for better results.

COMPONENTS OF EFFECTIVE REPORTING FOR BUSINESSES

Some important components of effective reporting are:

Compliance with Laws: Organizations complying with multiple laws must create reporting for each provision. This helps record the exact evidence of the control’s competence for the specific compliance process.

Scope of Reporting: Make it clear what your compliance report covers so that people can easily understand what will be in the report. Include a statement if a compliance officer looked over your report. It can also include things that the scope should have looked over or that might have been missed during the initial stage.

Incorporate Processes: In reporting, include a section considering the steps taken to ensure compliance. For example, you could discuss your steps to keep data safe and prevent breaches. Thus, try to be as compact as possible when you add the information. This will help you find any holes in your internal checks more efficiently.

Outcome Summary: The outcome summary tells you, in a few words, where your company stands. Therefore, knowing this position will help you decide new ways to improve compliance.

The steps are not mandatory, but including them in your reporting will help people understand them better. It will also help you find holes and give your company’s compliance reports method more meaning.

START YOUR COMPLIANCE REPORTING WITH CERTPRO

The compliance reports are essential for a competitive business landscape. It offers confidence, improves public perception, ensures risk management, and improves operational efficacy. However, the reporting requirements can be diverse depending on compliance needs. In addition, the process is complicated and time-consuming. Thus, you can get help from CertPro. Our expert auditing team will guide you in this regard and help you maintain effective reporting. Again, our help and assistance will improve your compliance practice and open up business opportunities.

FAQ

What is a compliance checklist?

Compliance auditors use a compliance audit checklist to check that a company follows government rules, industry standards, or policies.

What Makes an Effective Compliance Report?

An effective compliance report must be actionable and insightful to the reader. It must have clear and understandable language, concise findings, and a list of action items with timelines.

What are the challenges in compliance reporting?

The most common challenges are understanding the requirements, keeping up with regulatory changes, and training the employees for the reporting process.

What are compliance tools?

Compliance management software helps organizations comply with internal policies, regulatory, and legal requirements.

What are the four points in compliance reporting?

A compliance report needs to have four major parts: an introduction to the regulation, the report’s scope, an explanation of the report, and an analysis of the compliance process.

About the Author

Anuja Patil

Anuja Patil, an Executive Team Lead at CertPro, excels in guiding her team to deliver premier information security solutions. With a strong background in ISO 27001, SOC2, GDPR, and various other compliance standards, she ensures that projects are managed efficiently and security frameworks are continually optimized.

INFOSEC RISK MANAGEMENT IN 2024: EFFECTIVE TIPS FOR SIMPLIFICATION AND MITIGATION

In today's businesses, the value of information is no less than any asset a company possesses. However, consecutive cyberattacks and threats disturb the collecting and storing process of information. Thus, the incident of emerging cyber threats enhances the risk to...

TOP 9 RISK ASSESSMENT TOOLS FOR BUSINESSES IN 2024

Risk assessment helps organizations strengthen their security posture and recognize potential risks to their compliance processes. It also evaluates the severity of the risk and minimizes its impact on business operations. In addition, risk assessment tools are...

COMPLIANCE RISK MANAGEMENT: EXPERT STRATEGIES AND BEST PRACTICES

Compliance risk considers the organization's potential legal, material, and financial losses due to compliance failure. Thus, compliance risk is known as integrity risk. Organizations of all sizes are exposed to compliance risk. Hence, compliance failure results in...