Internal auditing is an important part of organizational governance, risk management, and control procedures. It is used to examine the efficacy of internal controls and internal audit steps, review risk management procedures, and assure compliance with laws, regulations, and internal rules. Internal audits provide management and stakeholders with independent and objective assurance, allowing firms to identify areas for improvement, eliminate risks, and increase operational efficiency.

Internal audits are performed to analyze and monitor the organization’s control environment, examine the appropriateness of risk management processes, and assure the accuracy and dependability of financial reporting. Internal auditing provides firms with useful insights into their operations, identifies control inadequacies or weaknesses, and executes remedial steps to improve overall performance.

In this essay, we will go deeper into the internal audit checklist, investigating its essential phases, value, and significance for firms. Organizations may leverage the power of internal auditing to promote continuous improvement and accomplish strategic goals by recognizing its complexities.

WHAT IS INTERNAL AUDITING?

Internal audit is a function within an organization that evaluates and assesses its internal control systems, risk management processes, and financial operations. It provides independent and objective assurance to the organization’s management and stakeholders regarding the effectiveness and efficiency of its operations. Internal auditors review the reliability and integrity of financial information, compliance with laws and regulations, and the safeguarding of assets. They also identify areas for improvement and offer recommendations to enhance internal controls and mitigate risks. Internal auditing helps organizations achieve their objectives by providing insights into their operations, identifying potential areas of fraud or mismanagement, and ensuring compliance with policies and procedures. It plays a crucial role in promoting transparency, accountability, and good governance within the organization.

THE PURPOSE OF AN INTERNAL AUDIT

Internal audits are undertaken to provide independent and objective assurance to an organization’s management and stakeholders. Internal auditing is a rigorous and disciplined process for assessing and improving the performance of risk management, control, and governance systems. Its mission is to identify and assess the organization’s risks, examine the design and efficacy of internal controls, assure compliance with laws and regulations, increase operational efficiency, and promote good governance and ethical standards.

Internal auditors play an important role in analyzing the organization’s risk management policies, assessing the reliability of financial reporting, safeguarding assets, and identifying opportunities for process improvement. They also contribute to the organization’s compliance efforts by reviewing compliance with applicable laws, regulations, and industry standards. Internal auditing is also useful.

The Ultimate Handbook for Internal Audit Planning Procedures

Firms use internal auditing as a systematic and organized process to assess the effectiveness of their internal controls, risk management practices, and overall governance framework. Internal audits give management and stakeholders independent and objective assurance that the organization’s activities are in accordance with regulatory standards, industry best practices, and internal rules.

I. Internal Auditing’s Importance

Internal auditing is critical for businesses because it provides an unbiased and objective examination of their operations. By having an internal audit procedure, the work gets easier. It aids in the identification of control flaws, possible dangers, and opportunities for improvement. Organizations can benefit from internal audits in the following ways:

Increase Risk Management: Internal auditing helps firms discover and analyze risks in numerous areas of operations, allowing them to establish effective risk management plans and reduce possible threats.

Ensure Compliance: The internal audit procedure assesses the organization’s adherence to laws, rules, and internal policies, ensuring compliance and reducing the risk of penalties, reputational harm, or legal ramifications.

Improve internal controls: Internal audit and internal audit plan checklists evaluate the design and performance of internal controls, allowing firms to enhance their control environment and protect assets, data, and sensitive information.

Enhance Operational Efficiency: Internal auditing assists firms in simplifying operations, saving costs, and enhancing overall efficiency by examining procedures and discovering inefficiencies or bottlenecks.

Facilitate Informed Decision-making: Internal audits facilitate informed decision-making by providing trustworthy and timely information to management and stakeholders, allowing for informed decision-making, strategic planning, and resource allocation.

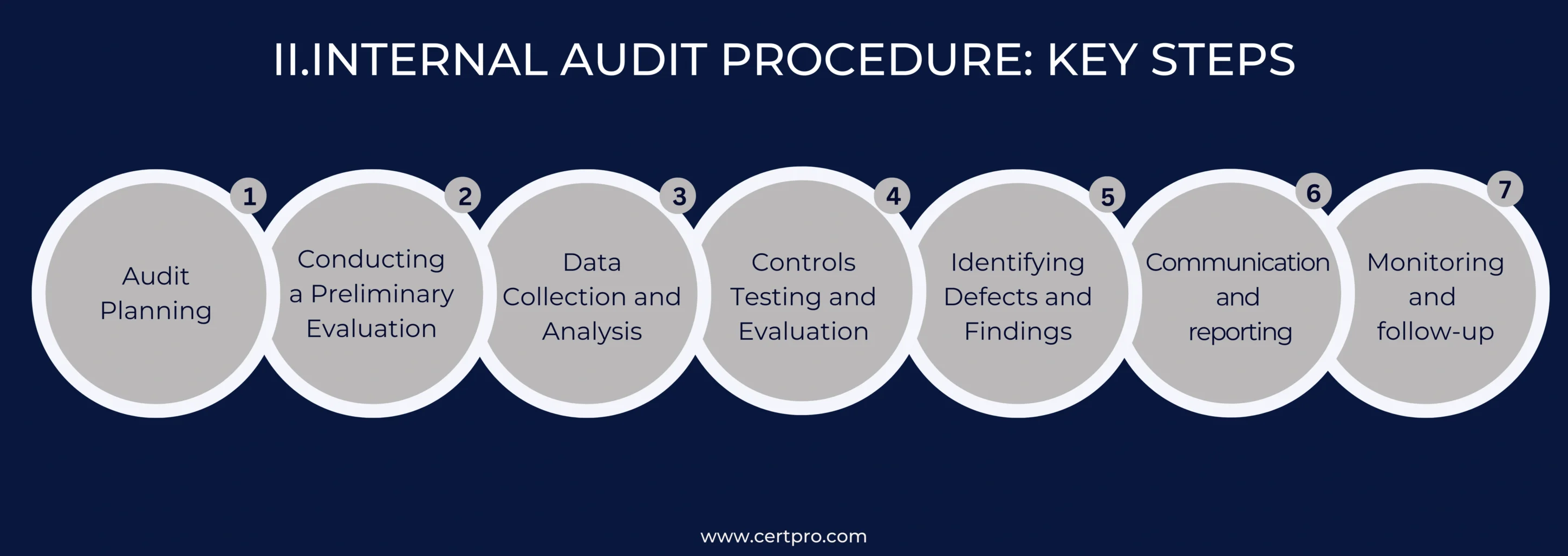

II.Internal Audit Procedure: Key Steps

The internal audit plan checklist consists of many important phases that ensure a thorough and systematic examination of the organization’s activities. These stages are as follows:

Audit Planning: The planning of the audit engagement is the initial stage in the internal audit planning procedure. The audit goals, scope, and criteria must all be defined. The internal audit team works with management to understand the goals, risks, and compliance needs of the firm. The audit strategy is customized to focus on high-risk areas and important procedures.

Conducting a preliminary evaluation: The internal audit team conducts a preliminary review before beginning fieldwork. Gathering background information, reading earlier audit reports, and comprehending the organization’s internal controls system are all part of this process. The team highlights possible hazards and control areas that need to be investigated further.

Data Collection and Analysis: Internal auditors acquire pertinent data during the fieldwork phase through interviews, observations, and document inspections. They examine the data to evaluate the design and operation of internal controls, as well as to check compliance and discover deviations from established processes or policies.

Controls Testing and Evaluation: Internal auditors conduct tests to determine the efficacy of internal controls. This includes transaction sample testing, documentation evaluation, and certification of policy and procedure compliance. The testing step aids in identifying control flaws, gaps, or instances of noncompliance.

Identifying defects and findings: The internal audit team finds findings and weaknesses based on data analysis and control testing. Findings are locations where controls are effective and working properly. Control flaws, noncompliance, or places for improvement are all examples of deficiencies. Each discovery is classified according to its seriousness and possible influence on the organization.

Communication and reporting: When the audit is finished, the internal auditors create a detailed audit report. The audit results are summarized in the report, which includes control weaknesses, non-compliance areas, and recommendations for improvement. The report is distributed to management, who receives important insights and concrete recommendations for addressing the highlighted concerns.

Monitoring and follow-up: The internal audit procedure does not end when the report is issued. It is critical to track the execution of audit recommendations. The internal audit team examines the progress of management’s corrective efforts to rectify detected problems. This guarantees that the organization’s control environment is constantly improved and enhanced.

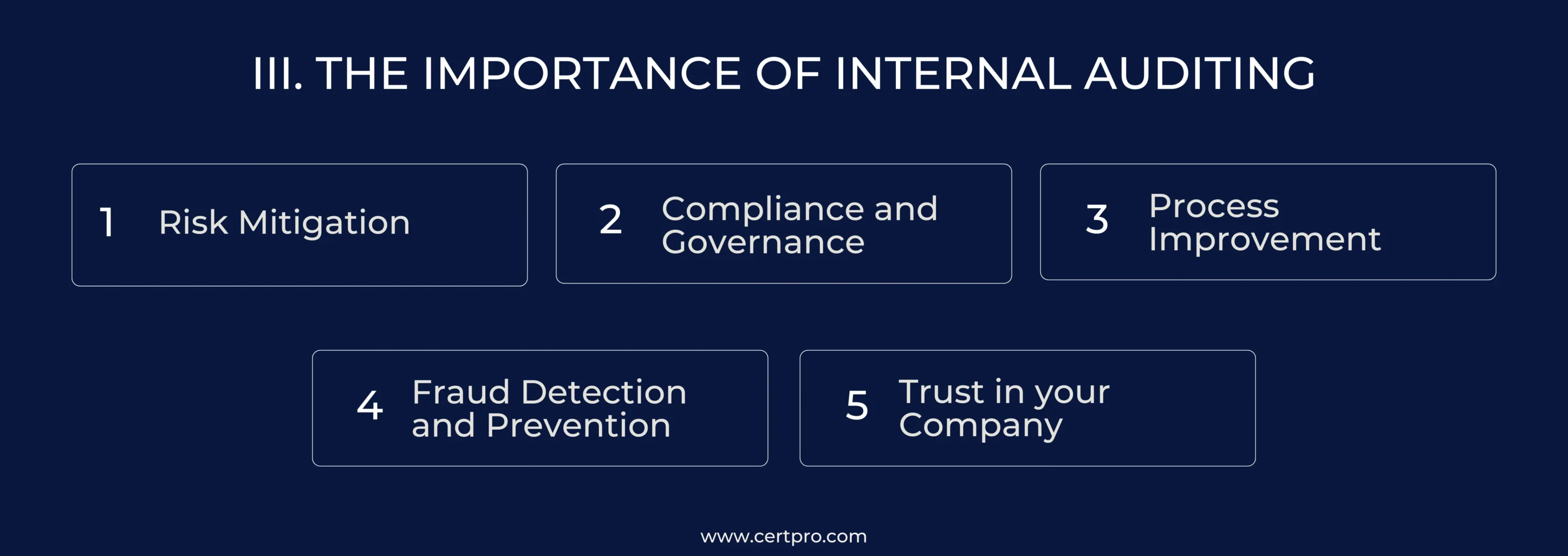

III. The Importance of Internal Auditing

Internal auditing adds tremendous value to firms by providing objective and independent assurance. Among the many advantages are:

Risk mitigation: Internal audits assist businesses in implementing suitable risk mitigation measures by detecting risks and control deficiencies, therefore safeguarding the firm from possible threats.

Compliance and governance: Internal audits guarantee compliance with laws, regulations, and internal rules while also fostering good governance and ethical behavior within the firm.

Process improvement: Internal audits uncover process inefficiencies, bottlenecks, and opportunities for change, allowing firms to simplify operations, improve efficiency, and cut costs.

Fraud detection and prevention: Internal audits aid in the detection and prevention of fraud by analyzing controls, discovering abnormalities, and conducting investigations. This safeguards the company against financial and reputational harm.

Trust in your company: Internal audits increase stakeholder trust in the organization’s operations, risk management, and control systems through independent assurance and transparent reporting.

Internal auditing is a critical component of a company’s governance architecture. It offers unbiased insights on the efficacy of internal controls, risk management, and compliance. Internal audits enable firms to discover areas for improvement, increase operational efficiency, and assure compliance with legislation and policies. Internal audits help organizations achieve their goals and preserve stakeholder confidence by promoting informed decision-making, strategic planning, and continual improvement.

Empowering Organizational Success with CertPro Internal Audit

CertPro, as a prominent provider of internal audit solutions, facilitates the optimization of organizational internal audit processes. Through our expertise and all-inclusive software platform, CertPro enhances the efficiency and efficacy of internal audits.

To begin with, CertPro delivers robust planning and risk assessment functionalities. This software simplifies the planning phase, enabling auditors to swiftly establish audit objectives, scope, and critical risk areas. It aids in identifying potential risks and control gaps, ensuring that audits focus on areas with the most significant impact.

CertPro streamlines data collection and analysis. Its comprehensive data management capabilities empower auditors to effortlessly obtain, organize, and assess data from multiple sources. This facilitates a thorough review of controls, the detection of trends or anomalies, and the comprehensive reporting of findings.

FAQ

What function do internal audit findings and recommendations play?

Internal audit findings and suggestions can significantly improve corporate performance. The findings reveal inadequacies in control, noncompliance, and areas for improvement. The suggestions give direction on corrective actions to solve identified issues, improve processes, and reinforce controls, resulting in continual improvement throughout the business.

What are the critical steps in an internal audit procedure?

Internal audit procedures are often divided into stages. Planning and scoping the audit, performing fieldwork and data collection, testing and assessing controls, identifying findings, and reporting the results to management are all part of the process. Each phase contributes to a full examination of controls and assures policy adherence.

How frequently should internal audits be performed?

Internal audit frequency varies according to criteria such as company size, industry, and risk profile. Internal audits are often performed on a regular basis, usually annually or quarterly. On the other hand, organizations may conduct ad hoc audits in response to significant developments, events, or emerging concerns.

What exactly is the distinction between internal and external audits?

Internal auditors within the company carry out internal audits, while independent auditors from outside the company carry out external audits. Internal audits are concerned with internal controls and risk management techniques, whereas external audits are concerned with the accuracy and fairness of financial statements.

What are the benefits of outsourcing internal audits?

Organizations can profit from outsourcing internal audits in a variety of ways. It gives access to specialist skills and knowledge, alleviates the strain on internal resources, and provides an impartial viewpoint. Outsourcing can also improve impartiality and reduce possible conflicts of interest that may develop when performing audits internally.

About the Author

SHREYAS SHASTHA DRUPADHA

Shreyas Shastha Drupadha, a Senior Business Consultant. Serving as an ISO 27001 Lead Auditor, Shreyas ensures the establishment of robust information security management systems. His expertise also encompasses GDPR, HIPAA, CCPA, and PIPEDA implementation.

INTERNAL AUDIT’S ROLE IN MITIGATING THIRD-PARTY RISK

In recent days, the Wisconsin Department of Health Services in the US reported a data breach of 19,150 medical health information in June 2023. According to their investigation, an unauthorized third party accessed the employee account, and data breaches occurred....

FINDING THE RIGHT AUDITOR: THE ULTIMATE CHECKLIST

Selecting an auditor to implement industry-specific rules and regulations is vital. The choice can influence the company’s growth and financial health. Therefore, choosing the right auditor offers valuable insights and ensures compliance and economic stability. You...

AI Audit Guidelines and Best Practices: Applying AI Towards Its Full Potential

Artificial Intelligence is entering different industries, where it is used for customer handling, data management, and documentation processes. The interference of AI is increasing concerns regarding ethical practice and safety. Therefore, AI audits have become more...