Corporate governance signifies that your business follows ethical practices and respects stakeholders’ expectations. In recent years, business management has become popular, and people are interested in learning about it. Therefore, business management is the rules and policies that control and maintain your organization’s operation process. The whole business management process is termed corporate governance. Thus, your business gains financial advantages if your corporate governance system is ethical and transparent.

Furthermore, the most effective component of corporate governance is Enterprise Risk Management (ERM). Again, it helps identify potential threats and create a mitigation strategy. In today’s dynamic business world, identifying risk is essential for business continuity and compliance with regulatory standards.

If you are looking for a solution to improve your organization’s transparency, accountability, and sustainability, then you are in the right article. In this article, you will learn about internal controls and why internal control is important in corporate governance. In addition, we will get ideas about the limitations and application of internal controls and how you can get expert support in this regard.

WHAT ARE THE INTERNAL CONTROLS?

Corporate governance consists of external and internal mechanisms. Internal mechanisms are known as internal controls that help in the accounting and auditing a company’s financial reports. Thus, the process ensures your organization’s financial integrity and regulatory compliance. In addition, it helps your organization comply with industry-specific regulations and eliminate the risk of fraudulence. The controls improve operational efficacy, identify capital deficits, and generate accurate reports.

Two main types of internal controls are found: one that avoids problems and one that investigates them. The goal of preventative control is to prevent mistakes or scams from happening. Some examples of this are careful paperwork and proper authorization procedures. When the first line of defense misses something, the detective controls pick it up.

Detective Internal Controls: It tries to find issues with a business’s work after an incident occurs. You can use them to achieve many goals, like ensuring quality, preventing scams, or following the law. In this case, reconciliation, which compares data sets, is the most important thing to do. Internal and external reports are two other detective tools.

Preventative Internal Controls: Separating tasks is key to preventative internal control. It ensures that no person can authorize a financial transaction and its assets. Thus, it includes authorizing bills, checking costs, and limiting direct access to assets like cash, inventory, and tools.

WHY IS INTERNAL CONTROL IMPORTANT IN CORPORATE GOVERNANCE?

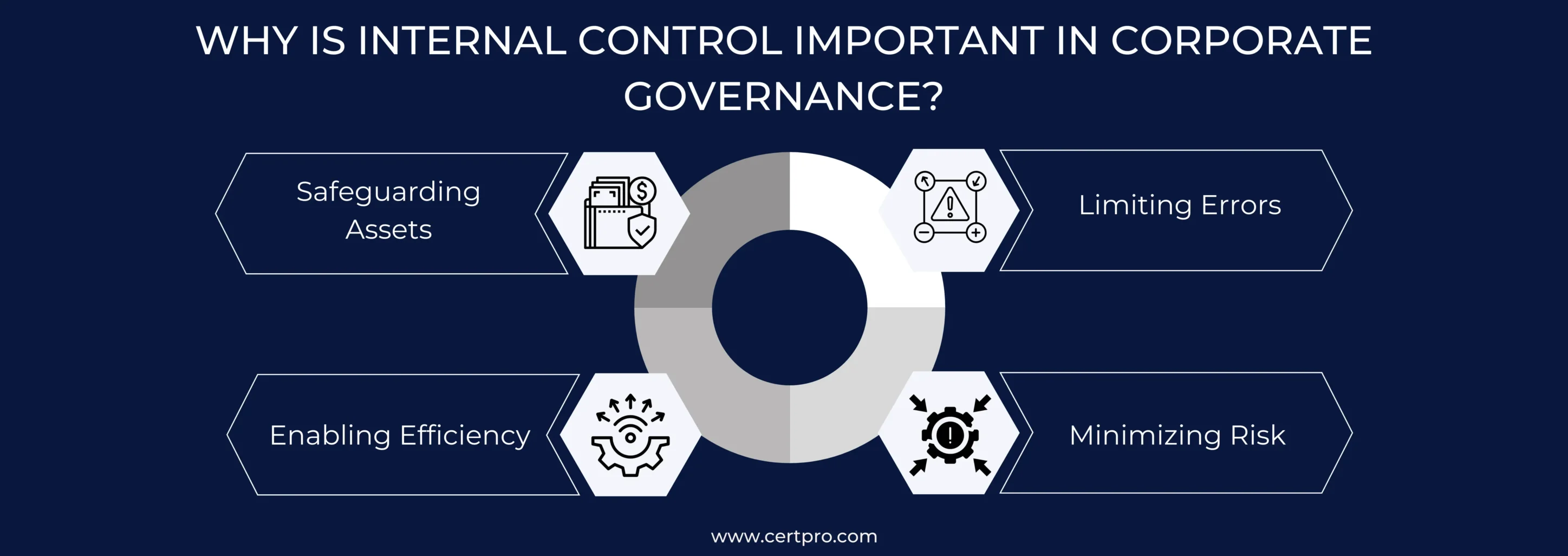

In short, internal controls are the rules and steps that keep your company’s assets safe by reducing or eliminating risk. Internal controls help you monitor activities and make changes to align with your organization’s goals. The organization’s leaders put in place rules to ensure compliance that aligns with the organization’s goals.

Furthermore, internal controls help keep track of internal and external controls reporting. SOX compliance means that management must examine a company’s internal processes. This allows partners to believe each other and stay aligned with SOX. Therefore, effective corporate governance provides a competitive edge. Here are some of the specific goals of internal controls:

Safeguarding Assets: Implementing internal controls eliminates the risk of asset loss due to fraud and errors.

Limiting Errors: The process ensures that financial information is carefully reviewed to reduce errors.

Enabling Efficiency: Internal controls prevent operational mistakes and improve operational efficiency in the long run.

Minimizing Risk: You can divide your company’s internal controls into preventive, detective, and corrective. Detective controls look for problems, corrective controls fix them, and preventative controls eliminate the risk. Thus, the whole process works together to achieve the goals.

WHAT ARE THE COMPONENTS OF INTERNAL CONTROLS?

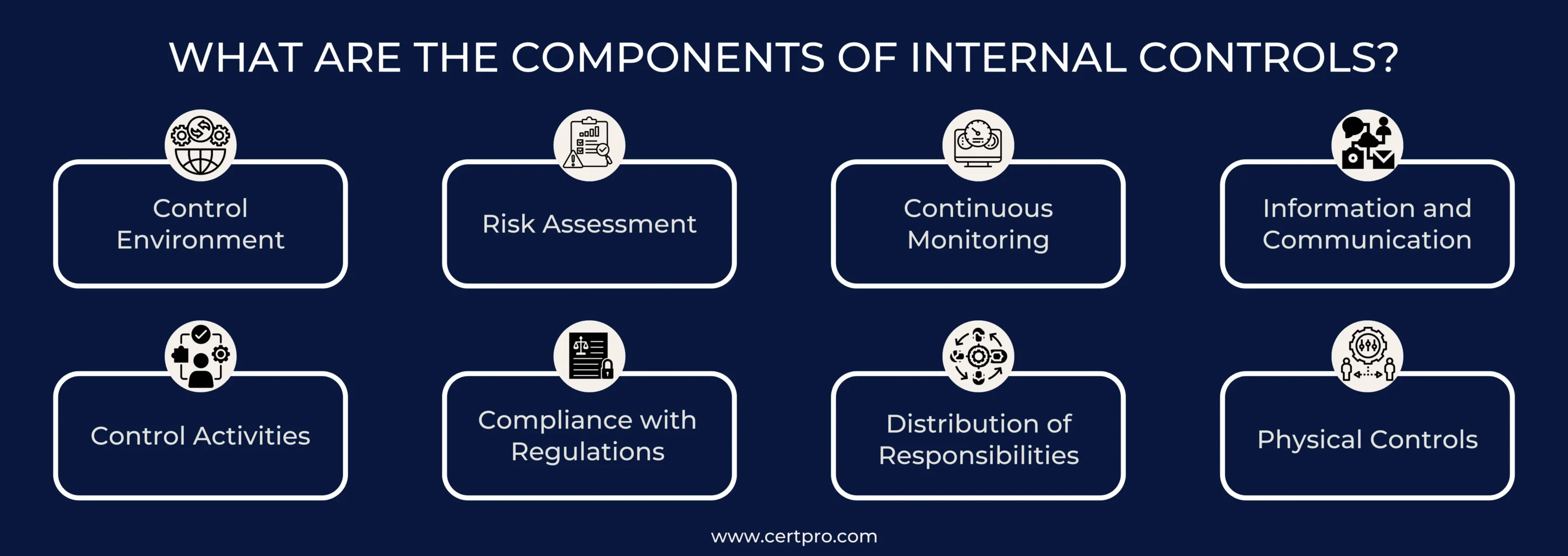

If you think of implementing internal controls in your organization, it must have the following components:

Control Environment: Your organization’s board members create an environment for internal controls and implement the process to achieve the goal. Thus, the process helps recognize your organization’s improprieties and vulnerabilities.

Risk Assessment: Conducting a regular risk assessment to identify potential and existing risks is essential. Therefore, risk assessment helps recognize and implement the correct controls to mitigate the risks.

Continuous Monitoring: Monitoring makes the process perfect and continues compliance. Therefore, the monitoring process ensures the system’s upgradation, offers employee training, and rectifies the flaws in the ongoing process.

Information and Communication: These are two crucial components: clarity of purpose and roles and facilitation of understanding and commitment.

Control Activities: It addresses the policies and other actions taken to maintain the integrity of internal controls and industry-specific regulations.

Compliance with Regulations: Your organization’s financial activities must adhere to industry-relevant laws and regulations. Thus, the process involves staying aware of changes in financial regulations and implementing measures to ensure compliance.

Distribution of Responsibilities: The distribution of work among the employees reduces the risk of errors. You can allocate people for authorization, control access, and keep records in your organization. Thus, it reduces the risk of mistakes, as the dedicated individual performs their task regularly.

Physical Controls: A business must implement security measures to protect its valuables, such as cash, inventory, and tools. These measures encompass safe storage facilities, preventing unauthorized access, and monitoring the situation.

WHAT ARE THE GUIDELINES FOR INTERNAL CONTROL OF CORPORATE GOVERNANCE?

The following are some of the most popular internal control methods used in business today:

Authorization: Authorization ensures that different employees can perform certain kinds of transactions. It’s a proactive way to stop illegal transactions. This includes approval authority rules that say certain managers must permit certain types of transactions. Thus, these rules add another level of responsibility to your records systems by showing that the transactions have been seen, analyzed, and given permission by the right people.

Documentation: Documentation is anything that shows proof of a transaction, who performed each task related to the transaction, and their permission to perform those tasks. Because documents record events and activities related to money, they ensure that deals are correct and complete. This includes costs, income, inventory, staff, and other deals. Correct paperwork can show what happened and give information for investigating problems. Standardized forms for financial transactions help your business keep records consistently over time. However, non-standardizing paperwork can eventually cause people to miss or misunderstand important information.

Reconciliation: When you reconcile, you compare deals and activities with the paperwork backing them up and fix the vulnerabilities you find. Once in a while, reconciliation ensures that your system’s balances match those kept by other companies, such as banks, sellers, and credit customers. In a satisfactory internal control system, there should be a way to check that deals and activities are legal for the right reasons and the right amounts. Any mistakes or inconsistencies should be found, and a proper response is needed.

Security: Three types of protection shield your assets and data: administrative, physical, and technological. Therefore, administrative security is all about each department’s steps to keep assets and data safe. Physical security keeps data secure in the real world and prevents the risk of theft or damage. Lastly, technical security keeps electronic data secure while being sent from one place to another. Keeping assets and data safe is best to avoid loss, damage, or access by people who shouldn’t have them. Protecting your assets and data is essential for keeping your business running. It ensures data accuracy and protects the safety of personal and private data.

Segregation of Duties: Shared responsibilities eliminate the risk of errors and improve the effectiveness of the process. Therefore, every organization must have separate functional responsibilities to ensure authorized transactions, reconciliations, and asset liabilities. The division of tasks will depend on your organization and how it is ultimately set up. Duties can be separated by department or by person within a department.

LIMITATIONS OF INTERNAL CONTROLS

Internal controls can only give a company a fair chance that its financial information is correct, no matter what policies and methods it has in place. In addition, Human judgment can limit the effectiveness of internal controls. The way people make decisions can affect how well internal rules work. Also, employees are responsible for implementing the internal controls. However, if the employees secretly violate the laws and regulations, then the risk of data breaches increases.

IMPROVE YOUR INTERNAL CONTROLS TO AVOID RISK

Businesses need internal rules to ensure honesty and the accuracy of their financial information. After companies like Enron and WorldCom went bankrupt, the Sarbanes-Oxley Act of 2002 pushed for better internal controls to protect investors from corporate theft. However, employees who skip over control tasks and work together to hide crime can weaken internal controls. A business uses rules and steps to ensure its accounting and financial data is correct, promote responsibility, and stop fraud. Therefore, ensuring that financial reports are accurate and sent on time makes the processes more efficient.

FAQ

What are the 4 P's in corporate governance?

It signifies people, purpose, process, and performance. These are the foundations of corporate governance.

What are the five 5 concepts of corporate governance?

The core principle of corporate governance is fairness, accountability, responsibility, disclosure, and transparency. The concept can attract investors and support the financial growth of organizations.

What are the 4 main theories of corporate governance?

The main theories are Agency theory, Stewardship theory, Stakeholder theory, and Sociological theory.

What is the best internal control framework?

Many publicly traded companies, law firms, and financial institutions use the COSO Framework to set up and keep up internal rules that make important business processes official.

What is COSO and COBIT?

Committee of Sponsoring Organizations (COSO) and Control Objectives for Information and Related Technology (COBIT) frameworks help create, manage, and maintain internal controls for fraud prevention.

About the Author

Shivaprasad Shetty

Shivaprasad Shetty is an ISMS Lead Auditor and Consultant, adept at developing, implementing, and auditing ISO 27001-compliant frameworks. He is also well-versed in SOC 2 compliance, GDPR, HIPAA, and ISO 42001 standards. Shivaprasad excels in ensuring compliance across regulatory frameworks and fostering a secure organizational culture.

IT COMPLIANCE IN 2024: ESSENTIAL TRENDS AND BEST PRACTICES

IT compliance is essential for every organization to secure the integrity and accountability of data. The process also helps develop the business and enhance its profitability. In today’s digital era, IT compliance has more than just a regulatory checkbox. It plays a...

POLICY MANAGEMENT SYSTEM: ESSENTIAL TOOLS FOR AUTOMATION AND SIMPLIFICATION

Growing businesses indicates that you become a master in your field and accurately manage all business-related policies. However, managing company policies can be daunting significantly when your business expands. Here, an effective policy management system can help...

NAVIGATING DATA PRIVACY FRAMEWORKS: A COMPREHENSIVE GUIDE

Globalization has intense effects on business functioning and scaling. In today's digital world, companies are generating an unprecedented rate of data that requires protection from emerging cyber threats. In addition, recurring data breaches and privacy concerns make...