Today, businesses are data-driven and highly susceptible to cyber threats. Therefore, compliance and being compliant are critical aspects. Multiple industries, such as healthcare, finance, and legal, require regulatory compliance for scale-up. Specific sectors have precise regulations and standards that must be incorporated. In general, the terms compliance and compliant are related to rules and regulations. But sometimes, the terms can be confusing. This article will delve into the difference between the terms and explain the underlying principles and concepts of both terms.

The information and understanding of compliance and compliant enable responsible use of the terms in regulations. Thus, operating legal boundaries and upholding ethical standards in diverse businesses and activities necessitates both being compliant and comprehending compliance.

Being compliant refers to the state or condition of effectively meeting specific criteria, while compliance encompasses the broader notion of conforming to rules, regulations, guidelines, or standards. Throughout this essay, we will explore the importance of these concepts within today’s complex regulatory environment. Additionally, we will explore the definition of compliance and what it truly means to be compliant.

WHAT IS THE DIFFERENCE BETWEEN THESE CONCEPTS?

Compliance means understanding the framework and conforming to specific industries and activities’ laws, regulations, or standards. It involves more than just understanding relevant regulations and establishing policies and procedures. The main objective is to identify and avoid threats in a company or organization. Different factors might contribute to this, including local, state, or federal laws, administrative rules, industry-specific standards, and recommendations from professional organizations. Compliance depends on industry-specific regulations and legal systems. For example, the healthcare industry must respect customer data privacy, whereas the financial sector must follow banking security rules. Thus, the organization must clearly understand industry-related laws and regulations. It helps to comply with the rules. However, failure to maintain the regulations might cause financial, legal, and reputational damages.

Consequently, compliance ensures risk mitigation and safeguards the company’s reputation. On the other hand, they are being compliant means meeting those standards successfully. It refers to the state or condition of adhering to particular requirements and authorities set forth by the regulatory authorities. Also, being compliant signifies implementing policies, procedures, and controls to comply with the necessary regulations.

Understanding the criteria and determining where there are gaps between current practices and the required standards are the first steps in this process. To fill such gaps and guarantee compliance, this review assists in identifying the essential procedures and activities. Handling any issues can entail putting new procedures into place, changing current systems, performing internal audits, and getting professional counsel. Being compliant is a continual process that must be monitored and evaluated often to ensure the set controls are still functional and in line with the changing regulatory environment. Furthermore, a regular monitoring process enables modifying controls to eliminate non-compliance risk. Therefore, adhering to compliance requires continuous monitoring of regulations per industry standards.

WHAT DOES COMPLIANT MEAN?

Compliant signifies that an organization will achieve its legal responsibilities to safeguard data privacy. Recently, Facebook faced $5 billion in fines for mishandling customers’ personal information. It was the latest aggressive stance for non-compliant. Therefore, defaulters are facing financial and reputational losses. Furthermore, non-compliant can cause poor reputation in the market. Thus, it affects business continuity and growth. Hence, it is essential to apply compliance regulations.

THE IMPORTANCE OF COMPLIANCE AND BEING COMPLIANT

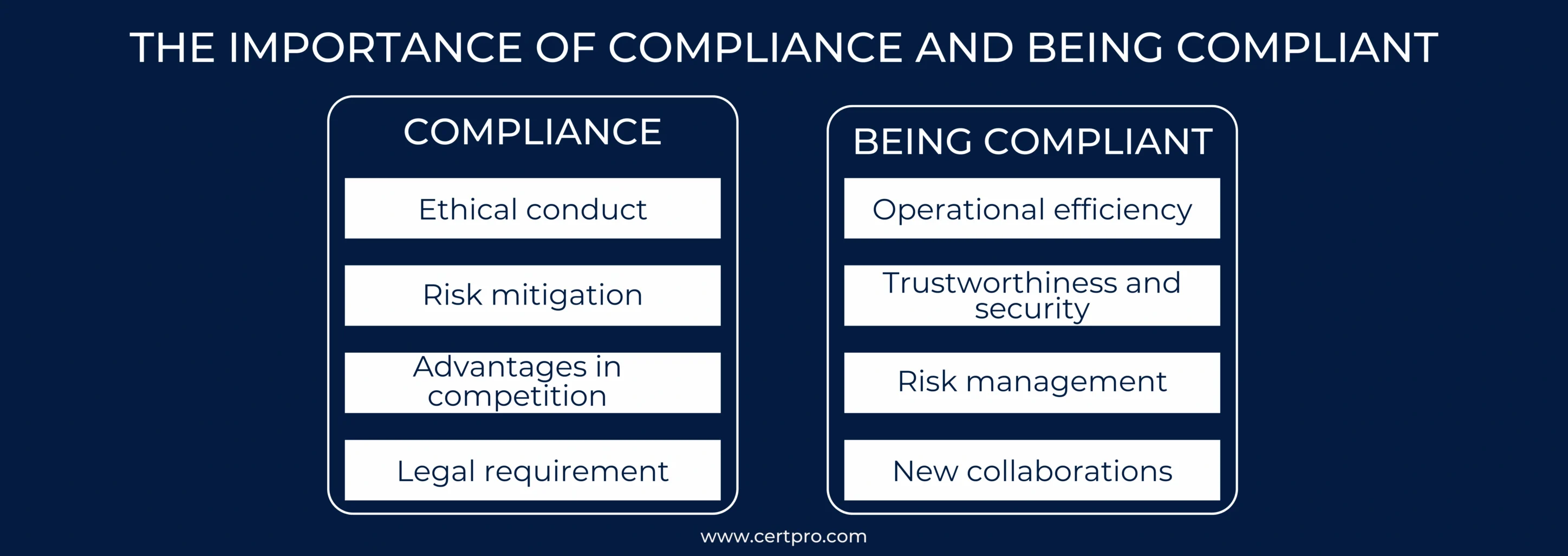

Compliance and upholding compliance are essential in many facets of business and society. Following are some of the main arguments in favor of this:

- Ethical conduct: Compliance ensures that people and organizations follow the rules by encouraging legal and moral behavior. It also aids in the prevention of unethical, fraudulent, and unlawful activity.

- Risk mitigation: Measures to ensure compliance help identify and reduce the risks of non-compliance. Companies can reduce their exposure to risk by implementing controls and adhering to established procedures.

- Advantages in competition: This may give you an advantage. Businesses that show dedication to this and ethical behavior frequently have stronger relationships with partners and investors, improved reputations, and consumer loyalty.

- Legal requirement: Regulatory agencies frequently enforce compliance as a legal requirement. Regulation non-compliance can lead to penalties, fines, legal actions, or even the liquidation of a corporation. Companies can avoid these repercussions by adhering to regulatory regulations.

In other cases, being compliant helps your company in specific ways:

- Operational efficiency: By simplifying procedures, guaranteeing uniformity, and lowering the chance of mistakes or non-compliance problems, these measures can increase operational efficiency.

- Trustworthiness and security: These measures encourage the organization’s culture of responsibility, honesty, and professionalism. Knowing they are working in a setting that follows moral and legal norms gives employees a sense of security.

- Risk management: Companies can successfully identify and manage risks when they are compliant. By implementing controls and monitoring procedures, potential hazards can be identified early and minimized before they worsen.

- New collaborations: Compliance may be a requirement for doing business in some sectors and with some clients. Being compliant opens doors to new partnerships, agreements, and possibilities that are only open to companies that fulfill the requirements.

Thus, compliance vs compliant are two essential components. Hence, being compliant denotes the effective use of steps to satisfy particular standards while establishing the framework of rules and regulations that govern diverse businesses and activities. Individuals and companies can grow in an ethical environment by comprehending compliance, actively seeking it, and adjusting to changing regulatory requirements.

THE LEGAL REQUIREMENTS NEEDED TO BE COMPLIANT

Being compliant with specific standards is very important for companies to operate within the boundaries of the law these days. The exact legal requirements for a company can vary depending on its circumstances. Business registration, observance of employment rules, payment of taxes, data protection and privacy compliance, anti-corruption measures, consumer protection, and environmental restrictions are some of the frequent legal requirements. These criteria call for actions including getting the required licenses and permissions, abiding by labor regulations, etc.

Activities that are part of compliance initiatives include getting the required licenses and permits, recording employment agreements and rules, keeping accurate financial records, performing routine audits, and putting in place data security measures. Companies may demonstrate their dedication to legal and ethical standards, reduce legal risks, and maintain compliance by actively addressing these legal obligations and regularly monitoring and responding to changes in laws and regulations.

WHO IS RESPONSIBLE FOR COMPLIANCE IN A COMPANY?

Depending on the size and organizational setup of the firm, different people are in charge of compliance. Senior management is often in charge of compliance, while compliance officers are in charge of planning and implementing compliance measures throughout the organization. They are responsible for ensuring staff members follow all applicable laws, rules, and corporate policies in all divisions and locations. Compliance officers perform this function by informing staff members of the most recent legislative and regulatory requirements and by routinely educating them on compliance-related subjects.

Compliance officers monitor employee compliance while also identifying possible hazards for the business and setting up procedures and standards to ensure regulations are followed. They continually assess and adjust compliance management to adapt to changing political or economic circumstances and new threats. The efficient use of a compliance management system (CMS) and compliance tools helps reduce the complexity of the work.

FAQ

What are the two types of compliance?

The two main categories of compliance are corporate compliance and regulatory compliance. Both types involve conforming to a specific set of laws, customs, and guidelines.

What are the five components that make up compliance?

Five fundamental components of corporate compliance may be derived from these main themes: leadership, risk assessment, standards and controls, training and communication, and oversight.

How can businesses successfully deploy a compliance management system?

It offers perceptions and suggestions on developing efficient compliance procedures, making use of compliance technologies, and adjusting to shifting regulatory requirements.

What roles do compliance officers perform at their jobs?

Compliance officers are essential to sustaining compliance within an organization. They stay current on the most recent legislative and regulatory standards, train staff on compliance-related issues, identify possible risks, and put policies and procedures in place to guarantee that the law is followed.

How can businesses make compliance management simpler?

Employing efficient compliance management systems (CMS) and compliance solutions allows businesses to streamline compliance management. These technologies support process streamlining, compliance activity monitoring, and standard and regulatory conformance.

About the Author

RAGHURAM S

Raghuram S, Regional Manager in the United Kingdom, is a technical consulting expert with a focus on compliance and auditing. His profound understanding of technical landscapes contributes to innovative solutions that meet international standards.

NAVIGATING DATA PRIVACY FRAMEWORKS: A COMPREHENSIVE GUIDE

Globalization has intense effects on business functioning and scaling. In today's digital world, companies are generating an unprecedented rate of data that requires protection from emerging cyber threats. In addition, recurring data breaches and privacy concerns make...

BUSINESS NON-COMPLIANCE: THE HIDDEN FINANCIAL AND OPERATIONAL COSTS

Businesses are always in a dilemma regarding whether or not to be compliant. Most companies think that compliance will problematize their operating process. However, highly regulated industries like financial and healthcare services meet the legal obligations for...

Security Frameworks: A Comprehensive Guide with 14 Examples

Technological advancements make cyberattacks more sophisticated and advanced. Hence, organizations must keep up with the latest cybersecurity frameworks in these complicated scenarios to sustain themselves in a dynamic threat environment. Different cybersecurity...