In the ever-evolving landscape of healthcare data management, the Health Insurance Portability and Accountability Act (HIPAA) stands as a sentinel of patient information security. Within this regulatory framework, the concepts of HIPAA Business Associate vs Covered Entity These terms, while interconnected, bear distinct roles in safeguarding patient privacy and upholding HIPAA compliance.

At the heart of the Health Insurance Portability and Accountability Act regulations are covered entities, which are the foundation of healthcare services. Business associates are external partners who work alongside covered entities to offer services involving the use, disclosure, or management of protected health information (PHI).

In essence, the difference between Covered Entities and Business Associates lies in their focal responsibilities and patient interactions. Covered entities embody the core healthcare providers, while business associates function as vital support entities, both collectively upholding the sanctity of patient data within the purview of HIPAA.

In this article, we delve into the nuanced world of healthcare privacy, understanding the pivotal role that HIPAA Business Associate vs. Covered Entity plays in nurturing patient trust and ensuring the confidentiality of sensitive healthcare information.

WHAT IS THE HIPAA PRIVACY RULE?

The Health Insurance Portability and Accountability Act Privacy Rule, enacted in 2003, stands as a pivotal component of safeguarding patients’ sensitive health information in the United States. Designed to ensure the privacy and security of protected health information (PHI), the Privacy Rule outlines standards that Covered Entities and Business Associates must follow when handling this data.

The Privacy Rule governs how covered entities, including healthcare providers, health plans, and healthcare clearinghouses, manage and disclose PHI. It empowers patients with greater control over their health information while establishing guidelines for permissible uses and disclosures.

The Rule mandates that covered entities obtain patient consent before using or disclosing their PHI for purposes other than treatment, payment, or healthcare operations. These encompass activities like billing, claims processing, and quality improvement initiatives.

The Privacy Rule doesn’t just apply to healthcare providers; it also extends its provisions to business associates—external entities that handle PHI on behalf of covered entities. Non-compliance with the Privacy Rule can result in substantial penalties, which vary based on the severity of the violation. Penalties range from civil monetary fines to criminal charges, with potential legal and financial consequences for both.

WHAT ARE HIPAA-COVERED ENTITIES?

Covered Entities under HIPAA are specific types of organizations and entities that are subject to the regulations outlined in the Health Insurance Portability and Accountability Act. These regulations pertain to the privacy, security, and confidentiality of protected health information (PHI) that these entities handle.

There are three main categories of covered entities under HIPAA:

1. Healthcare Providers: This category includes a wide range of healthcare professionals and organizations that provide medical services to patients. Examples of healthcare providers include doctors, nurses, hospitals, clinics, pharmacies, chiropractors, psychologists, and dentists.

2. Health Plans: Health plans encompass various types of insurance programs that provide coverage for medical expenses. This includes health insurance companies, health maintenance organizations (HMOs), Medicare, Medicaid, and employer-sponsored health plans.

3. Healthcare Clearinghouses: Healthcare clearinghouses are entities that process and convert non-standard health information into standardized formats, making it easier for health plans and other entities to process claims and other administrative tasks.

These covered entities have direct relationships with patients and are responsible for the proper handling of their protected health information. This includes maintaining the privacy of patient information, implementing appropriate security measures to prevent unauthorized access, and notifying patients in cases of data breaches.

The Health Insurance Portability and Accountability Act regulations extend beyond covered entities to encompass their business associates. Business associates are external entities or individuals that perform certain functions on behalf of covered entities and involve the use or disclosure of PHI.

WHAT IS A HIPAA BUSINESS ASSOCIATE ?

Business associates under HIPAA are external entities or individuals that provide certain services to covered entities involving the use, disclosure, or handling of protected health information (PHI). It plays a crucial role in the healthcare ecosystem by providing services that support covered entities’ functions but don’t involve direct patient care.

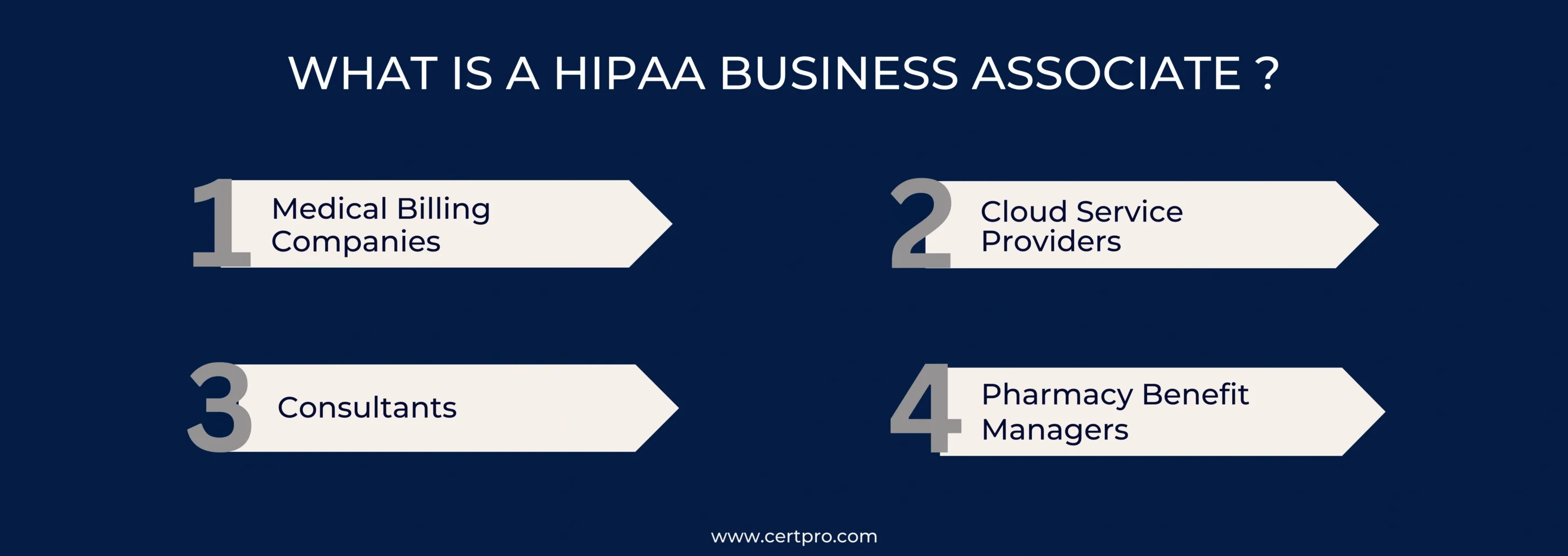

Some examples of business associates include:

1. Medical Billing Companies: These companies handle the billing and payment processes for healthcare services on behalf of covered entities. They often deal with sensitive patient billing and insurance information.

2. Cloud Service Providers: Entities that store and manage electronic health records (EHRs) or other patient data on behalf of healthcare providers fall into this category. As digital health records become more common, ensuring the security of stored data is essential.

3. Consultants: Individuals or firms that offer legal, actuarial, accounting, or other professional services to healthcare organizations can be considered BA if they come into contact with PHI.

4. Pharmacy Benefit Managers: These entities manage prescription drug benefits for health plans and are privy to patient prescription and medication information.

The concept of HIPAA covered entity business associate became more prominent with the introduction of the HIPAA Omnibus Rule in 2013, which expanded the definition of who is subject to Health Insurance Portability and Accountability Act compliance. As a result, business associates became directly liable for complying with certain Health Insurance Portability and Accountability Act requirements and could face penalties for non-compliance.

KEY DIFFERENCES BETWEEN COVERED ENTITIES AND BUSINESS ASSOCIATES

These are distinct entities within the healthcare industry, each with specific roles and responsibilities under the Health Insurance Portability and Accountability Act.

The key differences between covered entities and business associates are:

1. Direct Patient Interaction:

- Covered Entities: These have direct relationships with patients and provide healthcare services or insurance coverage directly to individuals.

- Business Associates: These do not typically have direct patient interactions. They support covered entities by offering specialized services, but they are not the primary caregivers.

2. HIPAA Compliance Responsibility:

- Covered Entities: These are directly responsible for complying with Health Insurance Portability and Accountability Act regulations, including the Privacy Rule, Security Rule, and Breach Notification Rule.

- Business Associates: These are also required to comply with specific aspects of Health Insurance Portability and Accountability Act regulations, especially those related to the security and privacy of PHI.

3. Direct Liability for HIPAA Violations:

- Covered Entities: They can be held directly liable for Health Insurance Portability and Accountability Act violations that occur within their operations.

- Business Associates: According to the Health Insurance Portability and Accountability Act Rule, they can be held directly accountable for HIPAA infractions. This means they can face penalties for non-compliance.

4. Patient Relationship:

- Covered Entities: They establish direct relationships with patients and provide them with medical care or insurance coverage.

- Business Associates: These do not typically have direct relationships with patients but support covered entity business associate agreements in delivering their services.

5. Business Associate Agreements (BAAs):

- Covered Entities: These may enter into BAAs with business associates to outline the responsibilities of each party regarding PHI protection and Health Insurance Portability and Accountability Act compliance.

- Business Associates: These are required to sign BAAs with covered entities to formalize their obligations to safeguard PHI and comply with Health Insurance Portability and Accountability Act regulations.

In summary, while both are integral to the healthcare ecosystem, they have distinct roles and responsibilities in relation to patient care, PHI protection, and Health Insurance Portability and Accountability Act compliance.

SAFEGUARDING HEALTHCARE DATA THROUGH COLLABORATION

In the intricate realm of healthcare data management, the Health Insurance Portability and Accountability Act establishes a strong framework for patient information security. HIPAA Business Associate vs. Covered Entity, while distinct, share the responsibility of upholding this framework.

Covered entities under HIPAA form the backbone of healthcare services, directly engaging with patients to provide care and insurance coverage. Their adherence to HIPAA regulations ensures patient privacy and data security, fostering trust within the healthcare ecosystem. Complementing their roles, business associates provide specialized support services, maintaining the confidentiality of protected health information (PHI) in collaboration with covered entities. The synergy between these entities creates a robust defense against breaches and privacy infringements.

Through HIPAA Business Associate vs. Covered Entity’s commitment to privacy and collaboration, they fortify the foundations of HIPAA, underscoring its significance in an increasingly digitized healthcare landscape.

FAQ

WHAT ARE COVERED ENTITIES, AND HOW DO THEY RELATE TO HIPAA?

Healthcare providers, health plans, and healthcare clearinghouses are examples of covered entities. They are directly subject to Health Insurance Portability and Accountability Act regulations as they handle patients’ PHI.

WHAT IS THE ROLE OF BUSINESS ASSOCIATES IN THE CONTEXT OF HIPAA?

Business associates are external entities that provide services involving PHI to covered entities. They assist covered entities in various functions without direct patient care.

WHAT TYPES OF SERVICES DO BUSINESS ASSOCIATES PROVIDE TO COVERED ENTITIES?

Business associates offer specialized services such as medical billing, data storage, legal consultation, and IT support to help covered entities operate efficiently.

WHAT IS THE HIPAA PRIVACY RULE,AND HOW DOES IT IMPACT PATIENT INFORMATION?

The Health Insurance Portability and Accountability Act Privacy Rule safeguards patients’ sensitive health information. It requires HIPAA Business Associate vs. Covered Entity to maintain the privacy and security of PHI.

HOW DO COVERED ENTITIES AND BUSINESS ASSOCIATES COLLABORATE TO PROTEXT PATIENT DATA?

HIPAA Business Associate vs. Covered Entity: Rely on business associates for specialized services while ensuring that PHI remains secure and compliant through signed Business Associate Agreements (BAAs).

About the Author

RAGHURAM S

Raghuram S, Regional Manager in the United Kingdom, is a technical consulting expert with a focus on compliance and auditing. His profound understanding of technical landscapes contributes to innovative solutions that meet international standards.

DIFFERENT HIPAA REQUIREMENTS: UNDERSTANDING THE RULES AND REGULATIONS

With increasing cyberattack trends, organizations must take appropriate measures to secure their lifeblood. Similarly, patient health and financial information need protection in the healthcare sectors. Therefore, the Health Insurance Portability and Accountability...

HITECH ACT AND ITS IMPACT ON MODERN HEALTHCARE

In 2009, the Health Information Technology for Economic and Clinical Health or HITECH Act was signed to transform the American healthcare industry. The laws worked as a forward-thinking process of changing patient services. In this regard, the Patient Protection and...

BEST PRACTICES FOR DATA PROTECTION IN THE HEALTHCARE INDUSTRIES

In the healthcare sector, safeguarding sensitive information about patients is extremely important. Patient data includes personal details, medical histories, and treatment plans. Therefore, it must be protected and should be confidential. Thus, breaches not only...