Internal auditing demands a combination of education, experience, and dedication to professional development. This article will go through the procedures and methods for starting a fulfilling career in internal auditing. Whether you are a new graduate considering your choices or a seasoned professional looking for a change, this comprehensive resource will provide you with the information and assistance you need to succeed as an internal auditor.

We will delve into the educational foundations required for a successful start, the value of practical experience, and the necessity of professional credentials. We will also look at the talents and characteristics that distinguish excellent internal auditors, such as analytical acumen, good communication, and flexibility in an ever-changing environment.

Furthermore, we will address the advantages of joining professional organizations as well as the need for constant learning to keep up with industry developments and laws. By utilizing these tools, you may expand your network, get useful insights, and establish yourself as a sought-after specialist in your area.

Starting a career as an internal auditor offers tremendous opportunities for professional development, employment security, and the possibility of making a lasting difference within businesses. So, let us now go on our road to gaining the information and abilities needed to become an internal auditor and to get internal auditor certification, paving the way to a successful and gratifying profession.

THE JOURNEY TO BECOMING AN INTERNAL AUDITOR

A combination of education, experience, and professional qualifications is often required to become an internal auditor. The following are the typical stages for getting an internal auditor certification:

1. A bachelor’s degree in accounting, finance, or a related subject is highly encouraged. Accounting fundamentals, financial analysis, and business ethics are all covered in this course.

2. To work as an internal auditor, you must have prior experience in auditing or a similar sector. Consider entry-level roles in accounting, finance, or auditing departments to hone your abilities and gain a better grasp of auditing procedures. This will help you build your portfolio.

3. Professional certifications indicate your knowledge and dedication to the discipline of internal auditing. The Institute of Internal Auditors (IIA) offers the Certified Internal Auditor (CIA) title, which is the most generally recognized accreditation for internal auditors. Depending on your field of interest, other useful qualifications include Certified Public Accountant (CPA) and Certified Information Systems Auditor (CISA).

4. Joining professional groups like the IIA may provide essential networking opportunities, access to resources, and opportunities for continuing education. These organizations frequently provide training programs, conferences, and other activities that can help you grow as an internal auditor.

5. Develop excellent analytical and communication skills. An Internal auditor must be able to analyze risks, identify control flaws, and suggest adjustments. Effective communication skills are also required for recording audit results, providing suggestions, and cooperating with stakeholders at various organizational levels.

UNVEILING THE TRAITS THAT DEFINE OUTSTANDING INTERNAL AUDITORS

An Internal auditor with exceptional abilities and traits stands out in their sector. For starters, they have great analytical and critical thinking abilities, which help them successfully analyze risks, discover patterns, and derive meaningful conclusions from difficult material. They painstakingly scrutinize financial records and internal systems, uncovering any mistakes and anomalies that others may ignore. This attention to detail assures the accuracy and integrity of their audit results.

Second, outstanding internal auditors have a strong sense of ethics and integrity. They preserve neutrality, independence, and secrecy throughout their work while adhering to the highest ethical standards. Their objective judgment and suggestions are founded on factual information, which fosters confidence and credibility in the auditing process. They establish an ethical culture inside the organization they represent by upholding ethical behavior.

Finally, outstanding internal auditors have good communication skills and the capacity to communicate difficult topics clearly and concisely. They are skilled in both oral and written communication, successfully communicating their results, recommendations, and insights to a wide range of stakeholders. Their communication abilities enable them to work with management, workers, and audit committees to create understanding and constructive change within the firm. These factors help gain internal auditor certification.

SKILLS NEEDED FOR AN INTERNAL AUDITOR

Certain talents are required to flourish in the profession of internal auditing. The following are the essential competencies for an internal audit role:

1. Communication Skills:Internal auditors must be able to interact effectively. When communicating with stakeholders like management, employees, and audit committees, they must communicate clearly and simply. Strong verbal and written communication abilities aid in the communication of audit results, suggestions, and difficult topics.

2. Critical thinking: Internal auditors with strong critical thinking abilities may examine circumstances objectively, ask probing questions, and detect possible flaws or holes in controls. They must think critically in order to make educated judgements and suggestions based on their audit results.

3. Analytical skills: Internal auditors must be analytically competent in order to examine and evaluate complicated material, discover trends, and develop relevant conclusions. To identify risks and areas for improvement, they must study financial data, operational procedures, and control systems.

4. Ethical conduct: Internal auditors have to hold themselves to the highest ethical standards and honesty. They are entrusted with sensitive information and must keep it private. Maintaining ethical behavior promotes the internal audit function’s objectivity, independence, and credibility.

5. IT Proficiency: Internal auditors should have a thorough grasp of information technology in today’s technology-driven economy. To properly do data analysis during audits, they must examine IT policies, identify cybersecurity concerns, and grasp data analytics technologies.

6. Risk Management Knowledge: Internal auditors must have a thorough grasp of risk management principles and frameworks. They must be able to identify and analyze risks, assess the efficacy of controls in reducing risks, and make risk mitigation suggestions.

Aspiring internal auditors may position themselves for success in the field and contribute successfully to organizational governance, risk management, and internal controls by learning and improving these abilities.

THE INTERNAL AUDITOR’S ROLES AND RESPONSIBILITIES

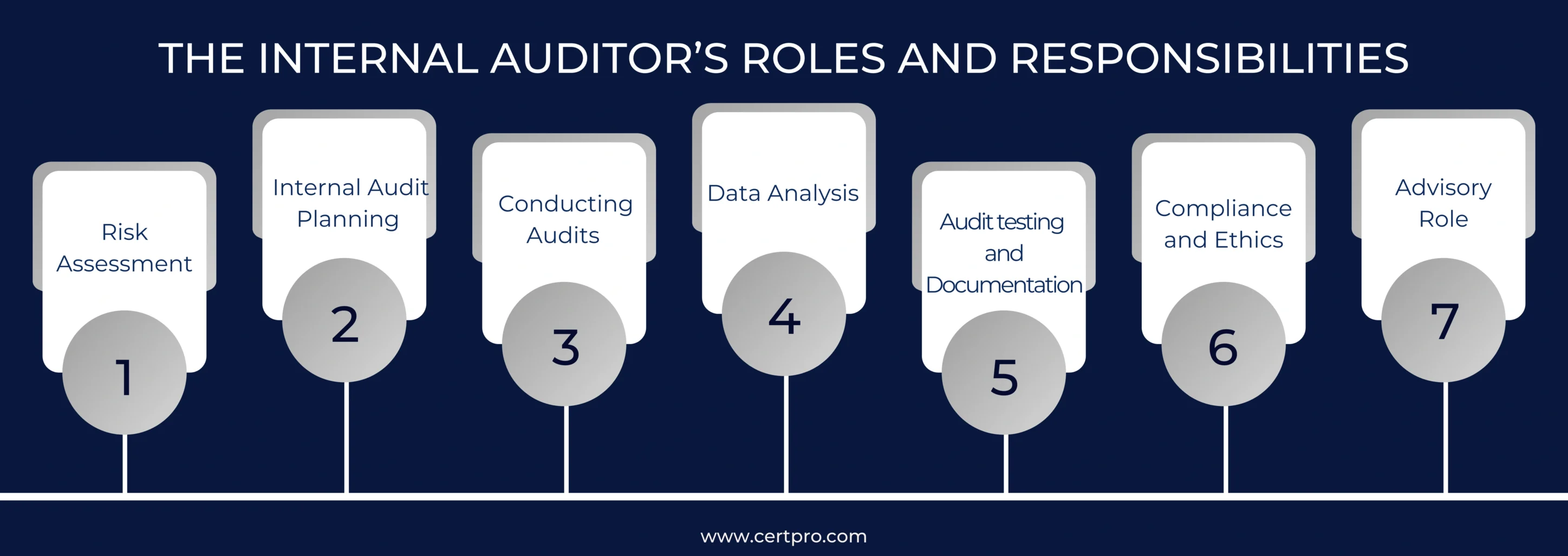

Internal auditors’ tasks and responsibilities might vary based on the business, sector, and employment needs. Internal auditors, on the other hand, often perform a few key duties. Internal auditors have the following important functions and responsibilities:

1. Risk assessment: Internal auditors play an important role in analyzing and evaluating hazards inside a business. They analyze possible threats to corporate objectives and assess the efficacy of current controls in mitigating those threats.

2. Internal Audit Planning: Internal audit planning is the responsibility of internal auditors. It describes the scope, objectives, and dates of audit engagements. Audit activities are prioritized depending on risk assessments and management priorities.

3. Conducting Audits: Internal auditors conduct audits to assess the sufficiency, effectiveness, and efficiency of internal controls, policies, and processes. They investigate financial records, operational operations, and legal and regulatory compliance. Financial reporting, business efficiency, IT systems, and compliance may all be audited.

4. Data analysis: Internal auditors use data analysis techniques to glean valuable insights from enormous amounts of data. They employ data analytics techniques and technology to uncover trends, anomalies, and patterns that may suggest possible dangers or opportunities for improvement.

5. Audit testing and documentation: Internal auditors undertake testing methods in order to obtain evidence to support their findings and conclusions. They keep audit workpapers that detail the type, timeliness, and scope of audit methods as well as the outcomes collected.

6. Compliance and ethics: Internal auditors evaluate the organization’s compliance with applicable laws, rules, and internal policies. They assess workers’ ethical behavior to ensure that ethical standards are maintained across the business.

7. Advisory role: Internal auditors may also give consulting services to management, such as risk management, process improvements, and strategic initiatives. They contribute to decision-making processes and help to improve the organization’s overall governance and control environment.

It is crucial to keep in mind that the organization’s size, complexity, and industry may change the tasks and responsibilities of internal auditors. Internal auditors may be assigned extra tasks based on organizational needs, such as fraud investigations, cybersecurity audits, or mergers and acquisitions.

FAQ

What makes you want to pursue a career as an internal auditor?

Every day, internal auditors have the chance to make a significant difference. They assist management in analyzing and enhancing the efficacy of risk management, internal controls, and governance processes implemented by management. They must be dependable in their abilities to evaluate critical concerns.

Is internal auditing a difficult job?

There is considerable tension involved in reviewing the work of others. Internal auditors must retain professional suspicion even while working with colleagues.

What are the obstacles that internal auditors face?

Internal auditors have always needed analytical and critical thinking abilities, but subject matter requirements are rising quickly. Cybersecurity, data mining and analytics, and a wide range of IT systems necessitate knowledge that is always evolving and changing.

What specifically are the four Cs of internal audit?

The 4C’s (criterion, condition, conclusion, and cause) are used to formulate audit results. It should be consistent with audit goals. Create audit recommendations that outline courses of action to improve internal controls. It might be either preventative or remedial.

How do I gain practical experience as an internal auditor?

Practical experience can be gained through internships, entry-level positions in auditing firms or corporate internal audit departments, or rotational programs within organizations. Seek opportunities to work on audit engagements, develop your skills, and learn from experienced professionals in the field.

About the Author

ANUPAM SAHA

Anupam Saha, an accomplished Audit Team Leader, possesses expertise in implementing and managing standards across diverse domains. Serving as an ISO 27001 Lead Auditor, Anupam spearheads the establishment and optimization of robust information security frameworks.

CYBERSECURITY AUDITS: A STEP-BY-STEP GUIDE TO CONDUCTING ONE

In recent years, data breaches have become headlines in many large companies. Technological advancements have made the hacking process more strategic and complicated. Therefore, organizations must consider the cybersecurity audit seriously to avoid breaches and have a...

INTERNAL AUDIT’S ROLE IN MITIGATING THIRD-PARTY RISK

In recent days, the Wisconsin Department of Health Services in the US reported a data breach of 19,150 medical health information in June 2023. According to their investigation, an unauthorized third party accessed the employee account, and data breaches occurred....

FINDING THE RIGHT AUDITOR: THE ULTIMATE CHECKLIST

Selecting an auditor to implement industry-specific rules and regulations is vital. The choice can influence the company’s growth and financial health. Therefore, choosing the right auditor offers valuable insights and ensures compliance and economic stability. You...